Which Best Describes the Underwriting Procvess Ofr Life Insurance

In the case of life insurance underwriting describes a companys process for reviewing approving modifying and perhaps rejecting a life insurance application. And just because this policy is a No Exam type of life insurance that does not mean there are no underwriting guidelines.

Life Underwriting And Claims Management Scor

Selection classification and rating of risk 3.

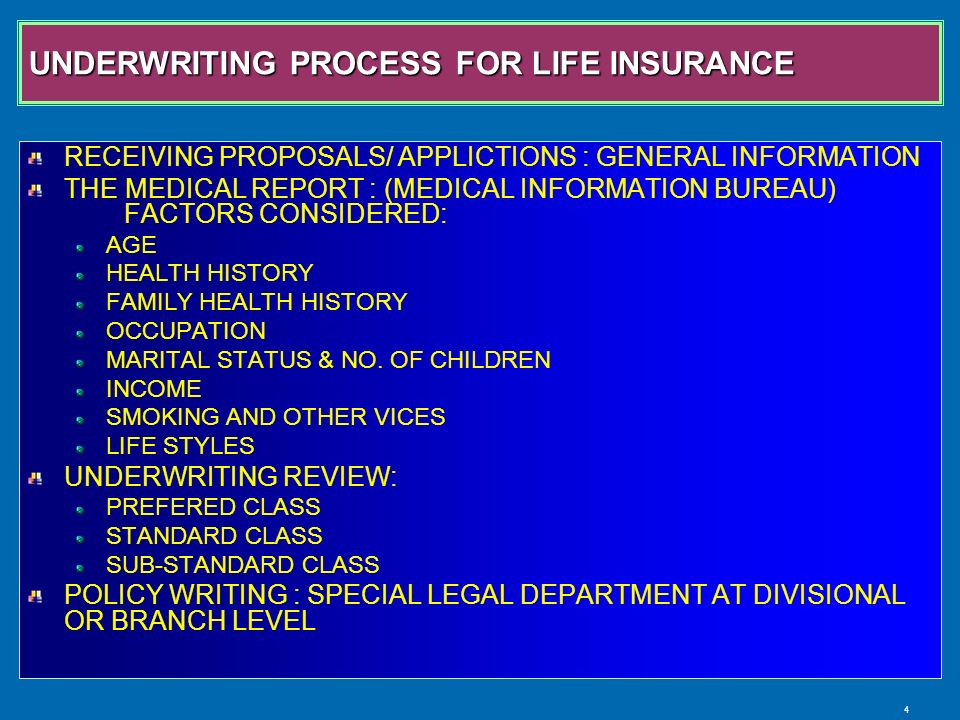

. It is the job of the life insurance underwriter to evaluate the overall risk of insuring a particular applicant for coverage. The process of underwriting takes place when an application is submitted to the life company. Life Insurance Underwriting Process The important tools for underwriting involve the age proof proposal form questionnaire sales report client confidential report CCR and income documents.

Reporting and rejection of risk 2. As a rule of thumb the healthier a person is the less risk heshe poses and the lower rates heshe will get. Underwriting is a term used by financial service providers including insurance companies that assess the eligibility of a customer to obtain products.

But even if you have a history of health conditions or risky behavior you could still find a life insurance policy. By using an actuarial or mortality table. Life insurance underwriting is a critical stage in the purchasing process when insurance companies evaluate your application and determine appropriate pricing for your policy.

You transfer the risk of financial loss from your death to the insurance provider. What Is The Life Insurance Underwriting Process. Insurers take a risk when they sell a life insurance policy.

How do insurance companies set the premium. Many forms of default levels of life insurance provided by superannuation and workplace schemes and in some direct to consumer policies do not require underwriting. In essence life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve deny or rate up a life insurance policy.

A set of activities used to identify the risk and rewards of investing an. A Selection classification and rating of risks B Solicitation negotiation and sale of policies C Issuance of policies D Reporting and rejection of risks. An individual signed an application for a 100000 life insurance policy and paid the first premium on January 1.

Every life insurance company has its own underwriting guidelines to calculate your final premiums. This happens before the underwriter looks at your application in detail. Which of the following best details the underwriting process for life insurance.

Part II of the life insurance application includes. And Canadian life insurance companies whose primary purpose is to detect and deter fraud that may occur when someone applies for life insurance. To assess a persons risk life insurers rely on information from a range of sources.

Life insurance underwriting is the process that determines how risky you are in the eyes of your insurer. Which of the following best details the underwriting process for life insurance. Asset Under Construction AuC Process Flow in SAP.

Life insurance underwriters decide who the insurance company will and will not insure. The MIB is comprised of a group of US. For taking on that risk you pay a fee known as a premium.

The specific process varies across companies but most underwriters follow roughly the same steps outlined below. Insurance underwriting is best described as. An insurance company uses underwriting to evaluate an insurance application.

Before approving your application. What is Life Insurance Underwriting. Step 1 Quality check of a life insurance application.

Following is the life insurance underwriting process based on different underwriting tools. Audit Flowchart Claim Data Processing Flow chart. The agent issued an insurability receipt.

The underwriting process. Life insurance underwriting takes place on two bases. A process of developing taxing structures for insurance policies.

That is in assessing life insurance risks the underwriter takes a look at the health and medical history as well as lifestyle information such as hobbies and financial ability of the prospective assured. Production-related activities performed primarily by agents on the field. It has a direct effect on your premiums young healthy people typically get the best rates because their risk is lowest.

Solicitation negotiation and rating of risk 4. It is the process of assessing the life insurance application of a potential customer. Which of the following best describes the concept that the insured pays a small amount of premium for a large amount of risk.

In doing so the underwriter will also set the premium price for the applicants insurance policy. Commercial insurance there are a variety of commercial health insurance plans that a consumer can purchase. As part of the underwriting process the insurance company will gather information from the MIB Group Inc.

Insurers have underwriters who try to know as much about you your finances dependents health habits etc. If an applicant for life insurance policy is found to be substandard risk the. Financial underwriting and Medical underwriting.

The underwriting process from a Simplified Issue carrier is the result of three reports. Life insurance is all about assessing risk. Before you buy your.

Fully underwritten underwriting will always require a medical exam and provides the underwriter with a clear picture of your health. Selection classification and rating of risk. Which of the following best details the underwriting process for life insurance.

15 best Microsoft CRM Sales Process images on Pinterest. MVR Motor Vehicle Record MIB Medical Information Bureau and RX Medical Prescription Report. Deciding whether to shop for fully underwritten life insurance or no exam life insurance generally depends on how much insurance you require and whether you are opposed to having a medical exam.

A week later the required medical examination proves the person insurable. Financial underwriting guidelines on life insurance used for estate planning are generally based around a formula that considers the prospective insureds current net worth and current age anticipated expenses and growth and the types of assets held.

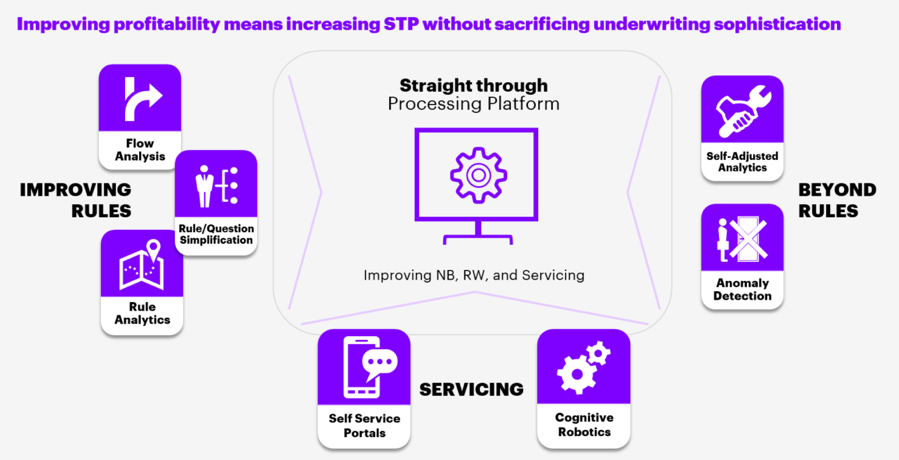

Underwriting In Insurance Ppt Download

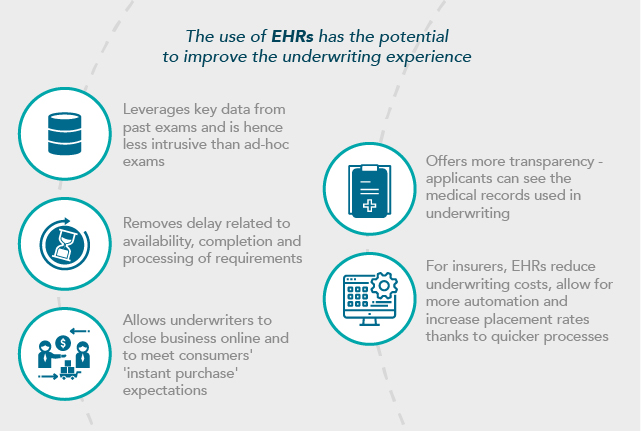

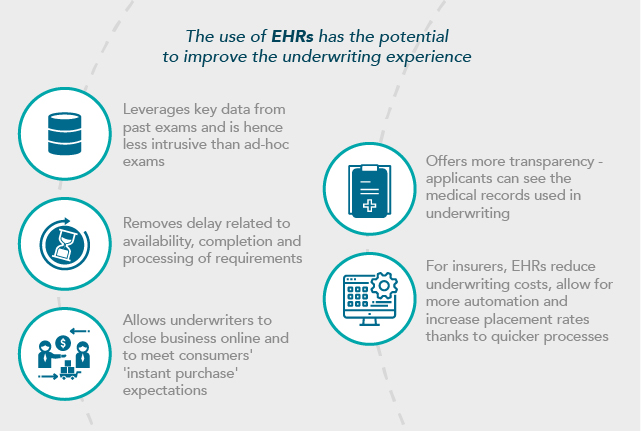

Brilliant Basics How To Improve The Core Of Underwriting In Small Commercial Accenture Insurance Blog

No comments for "Which Best Describes the Underwriting Procvess Ofr Life Insurance"

Post a Comment